Paid Ad Strategy During the Pandemic

Our world is profoundly disrupted. The unexpected outbreak of COVID-19 is holding a yield sign to social activity, disrupting people’s daily routines. Companies are filing for bankruptcy (e.g. Neiman Marcus). Global healthcare is battling to save patient lives. Governments are launching unprecedented financial aid programs. This life-changing situation also presents unique situation for advertisers. Facebook and Google have decreased the cost of advertising as they feel pressure from the pandemic. Carefully analyzing a myriad of factors – consumer behavior, industry, digital focus, ad KPIs – helps with the strategic decision of whether to increase, decrease, or even pause ad spending and how. If your company is fortunate enough to navigate these factors, it is a great opportunity to grow.

Table of Contents

Pandemic Consumes Mindshare

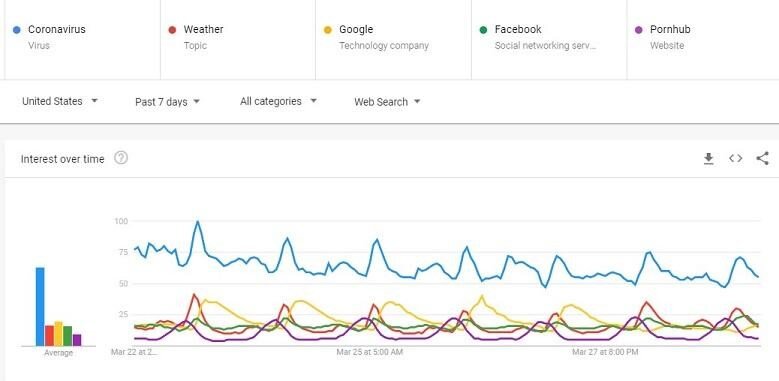

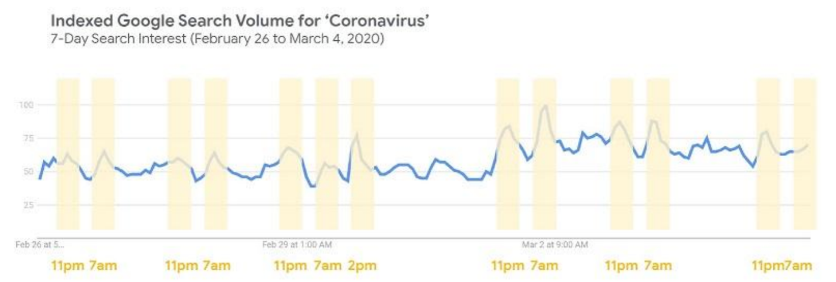

The pandemic consumes search from COVID-19 news to protection methods and economic concerns. Coronavirus is the first and last thing in people's minds every day with COVID-19 related searches spiking early morning (6am-7am) and late night (after 11 pm). Before the pandemic, search peaks occurred at noon and after dinner.

Source: WordStream

Source: Google Trends

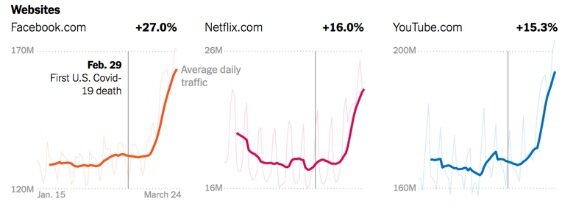

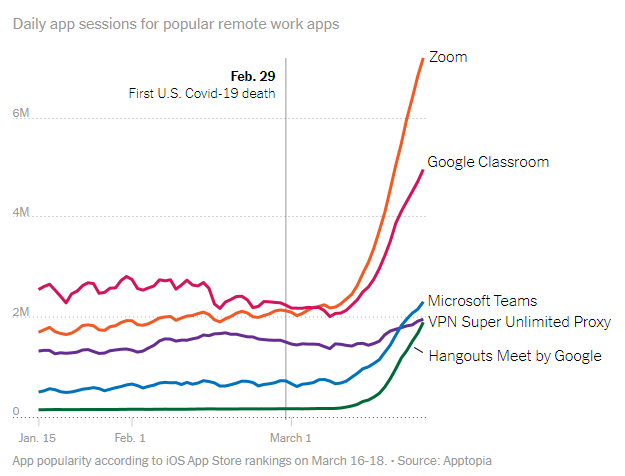

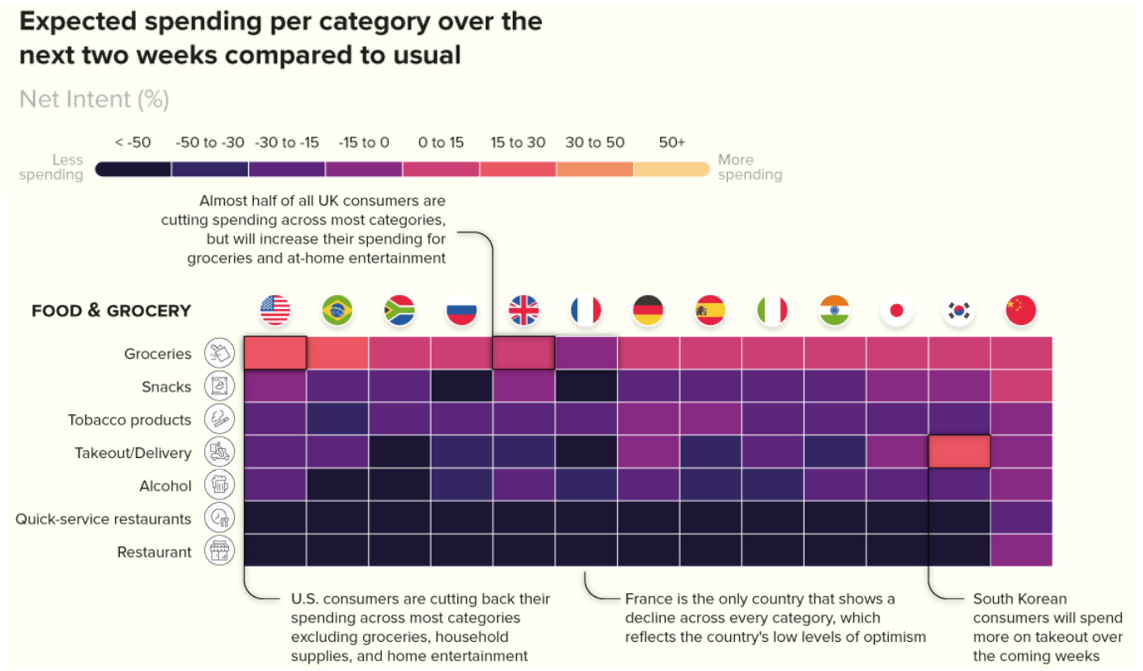

Consumers Adapt Behavior

As COVID-19 keeps an unprecedented number of people at home, they are living a more digital life. Internet traffic has surged by 50%-70%. And what are they doing? New York Times did analysis that showed people are looking to connect and entertain themselves through social networking and streaming sites. Facebook, Netflix, YouTube, Zoom, and Ecommerce usage has increased significantly. Video conferencing company Zoom added 2.22 million monthly active users in 2020, larger than the entire 2019 annual growth, according to Berstein Research.

Facebook and Google Struggle

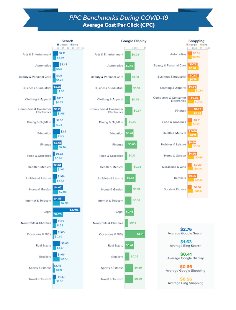

In contrast to the increased Facebook and Google usage, Cowen & Co’s analysts estimated their ad revenue together would plunge by $44 billion. These platforms depend on advertisers of all sizes who are facing existential challenges. Scott R. Baker published a study showing that after stockpiling and visiting retailers before lockdown, spend dropped sharply across industries as the virus spread and more households stayed home. People become more conservative facing uncertainty about future income which hurts ad conversion rates. According to Wordstream, search ad conversion rates are decreasing. As search volume peaks at midnight, conversion rate decreased 10%-15% pre- and now 30% post-pandemic. People are not only tired, but also less likely to convert while absorbing daily COVID-19 recaps. With pressure on organic and paid conversions, advertisers have decreased ad spend 69% and social media posting 74% (Source: Influencer MarketingHub survey) and cost of media followed. Facebook CPMs and CPCs dropped by 50% in North America (Source: Socialbakers). Google Search CPCs decreased significantly in specific industries according to Wordstream.

Unique Advertiser Opportunity

If your company is one of the fortunate ones to be well situated amongst all these complex factors, this is a unique opportunity to grow your business. We analyzed 3/16-3/21 paid ad performance across 10 industries using Wordstream COVID-19 Search Ad report on ~16k US advertisers versus Wordstream’s 2019 benchmarks as well as consumer behavior, digital focus, and sub-industry trends to help your company make this strategic determination.

Industries Trending Up

Generally industries that possess ecommerce & digital distribution direct-to-consumer (“D2C”) capabilities as well as rapidly partner & innovate (even re-create themselves aka “agile on steroids”) are best positioned during this period. They will embrace and/or adapt to consumer behavior during this socially distanced period of unknown duration. Their leadership will invest strategically in areas including this unique advertiser opportunity to win during the pandemic and beyond. Welcome to an even more digital world.

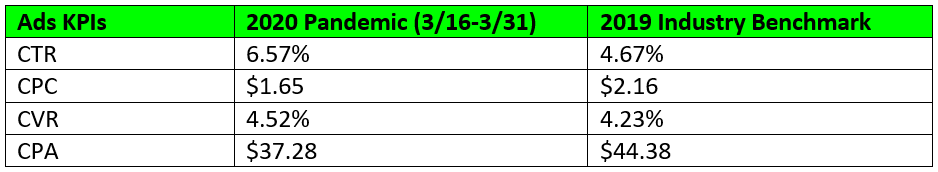

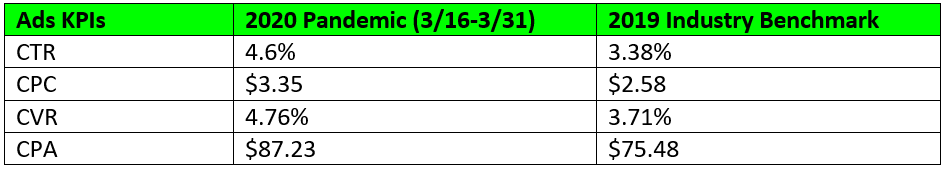

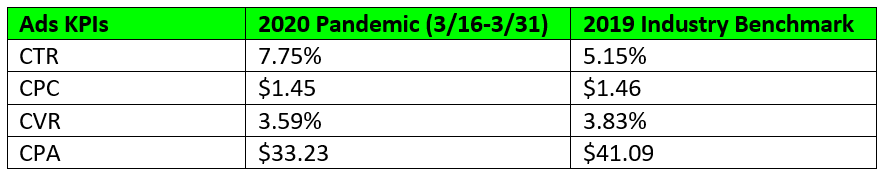

Retailer and Ecommerce

Traditional retailers have been investing in ecommerce capabilities for many years as 75% said store traffic is significantly lower (Source: CommerceNext). Grocery apps from major players like Costco and Walmart have skyrocketed. Walmart’s app downloads have increased by 190% in March. Every paid ad KPI is moving in the right direction with the most dramatic improvements in CTR (45%) and CPC (20%) which contribute to a 15% CPA improvement. These trends take place for many reasons – e.g. Amazon has paused its Google Ads with its focus on necessities (household staples and medical supplies) which lowers CPCs in non-essential categories. Capitalizing on these trends and specific opportunities, ecommerce ad spending is up by 34% during COVID-19.

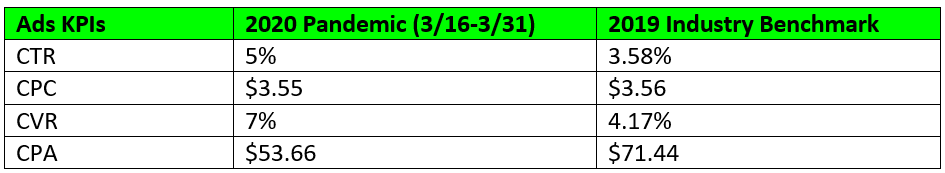

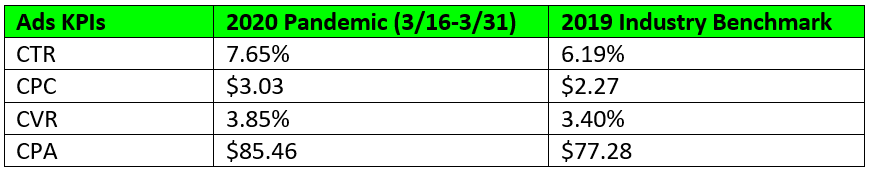

Beauty and Personal Care

Over the last several weeks the Beauty and Personal Care is increasing steadily. Beauty product ecommerce sales are increasing 60% month-over-month. According to Nielsen, hygienic items like hand sanitizers and medical mask sales are increasing by more than 300%. Every paid ad KPI is moving in the right direction with the most dramatic improvements in CTR (75%), CPC (60%), and Conversion Rate (50%) which contribute to nearly a 2x improvement in CPA. These trends are led by specific categories with massive opportunities because their ad KPIs improved - spa care CPC (20%) and Conversion Rate (40%) as well as skin care conversion (20%). The growing ecommerce business especially skincare and personal care plays a large role in this industry’s flourishing. Advertisers also need to factor in the consumer shift toward Amazon for staples while luxury and discretionary purchases remain focused in brand websites (Source: Stella Rising).

Source: ShipBob

Source: Wordstream

Finance

While the financial industry is challenged by both the stock market crash and pandemic, paid ad KPIs are strong because conversion rate increased by 75% contributing to a 30% CPA improvement. As the unemployment rate rises and business slows down, people are searching for financial assistance and experts to resolve financial distress. Google search for "financial consultant near me" increased by 3,700%.

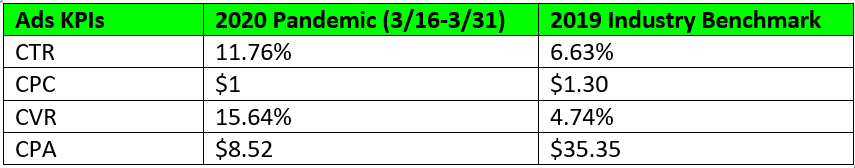

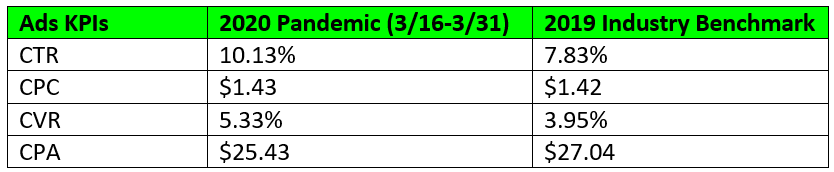

Dining and Nightlife

From February to early March, restaurant reservations crashed. OpenTable app shows reservations in Seattle decreased 31% by March 3rd compared to previous year. In the second week of March, WHO announced COVID-19 as a pandemic; restaurants & bars were restricted to providing takeout or delivery services. Grocery app downloads skyrocketed in the US. COVID-19 has frozen the dining-in restaurant business but paid ad performance is doing well. Restaurateurs see nearly 2x CTRs and 4x Conversion Rates which has contributed to an 80% CPA reduction on Google search as they limit their services to take out and delivery. While restaurant tables are empty, more customers are ordering pickup & delivery as restaurants convert diners more effectively online than they were a month ago.

Source: Eater.com

Source: The Visual Capitalist

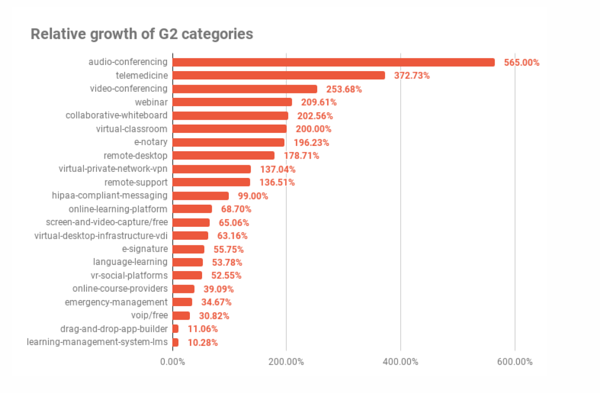

Business-2-Business ("B2B")

B2B is comprised of a variety of software, services, and supplies. The 20% conversion rate increase was offset by the 25% CPC increase contributing to a 10% CPA increase. While these economics aren’t favorable, there is a massive opportunity for B2B sub-industries that minimize the work disruption in the remote context. Software like telemedicine, webinars, collaborative whiteboards, and remote support are growing rapidly (Source: G2) into a remote stack as compiled by CabinetM. Office supplies became a sudden breakout industry with increases in searches 90%. As traditional retail has shifted focus to operating online, packing and shipping supplies more than doubled their search ad conversions (up 123%) and search ad conversion rate (up 107%).

Source: G2

Source: CabinetM

Industries Trending Down

For the selection of industries trending down, some are expected, some are surprising, and some contradict the ad KPIs; despite all this, sub-industries in each are still able to seize the unique advertising opportunity. Unfortunately, many will not be able to advertise and some will no longer be viable entities – they’ll go brankupt.

Travel and Tourism

Travel and tourism is one of the most severely impacted industries. As government and health institutions restrict travel, about 50% of US adults canceled their itineraries. While the ad KPIs look good, conversion rate increasing 20% and CPA decreasing 5%, it’s unclear how many conversions will be reversed with the uncertain pandemic end. So the travel industry cut ad spending on digital ads by 62% from February. When there is a clear end in site to this pandemic, advertisers can jump back in pending cash flow health.

Sports and Fitness

As large gatherings are discouraged by the government, major sports leagues are cancelled. Sports websites are seeing lower traffic due to less content opportunities. Gyms and parks are closed due to increasing social distancing mandates. Sports and fitness CTR increased 50%, conversion rates dropped 5%, and CPA decreased 20%. While ad KPIs look good, we need to look deeper. Conversion rate & CPA improvement is driven by camps whose conversions could get reversed i.e. cancellations & refunds. Some gyms provide online training programs but due to the pervasive free training videos online, it is still tough to recover from the shutdown.

Source: Wordstream

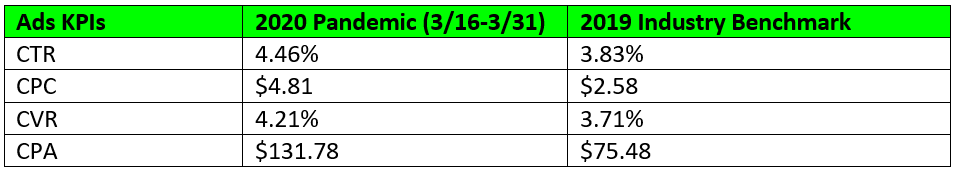

Real Estate

Overall real estate industry is negatively affected by COVID-19. As paid ads become 33% more expensive, that outweighs the 10% conversion rate improvement contributing to a 10% higher CPA. The hospitality industry is suffering especially in tourist destinations. With most workers at home, real estate development and construction are interrupted with decreased conversion rates 53% and 7% respectively, and lower search volume. Both real estate listings and agent searches have seen ~15% CPC increase. Conversion rates for real estate listings decreased 25% while for real estate agents and brokers increased 30% as consumers become hesitant to participate (e.g. attending open houses).

Internet and Telecom

Due to lockdown and stay-at-home, internet and telecom demand is rising. High-speed connectivity and devices help to counter the virus spreading, support remote working, and ensure business operations continuity. Conversion Rate has improved by 15% while CPC has nearly doubled so overall CPA nearly doubled also. This commodity industry was already hyper-competitive prior to COVID-19 and paid advertising economics got severely worse.

Relevance & Dynamic Advertising Wins

After you decide paid advertising strategy & budget, then comes execution. Firstly, fundamentals must be solid. Since the virus, government, and consumer behavior evolve so rapidly, dynamic approaches to advertising become even more important. Dynamic creative, product selection, and bidding will pay dividends as you adapt more rapidly than the competition and better seize this unique advertising opportunity. Dynamic or multivariate testing helps advertisers deliver the best-performing creative combinations to the right audiences programmatically with less time and money than A/B testing minus some more time upfront. Wordstream ran a dynamic creative experiment recently that drove a 55% CPA improvement. Growth Engines Powered by GMA ran a dynamic messaging experiment recently that drove a 33% CPL improvement. All dynamic campaigns rely on accurate data for optimization so double- or triple-check your integrations before kicking these off and add them to your ongoing tech release QA test conditions.

Advertiser Special Programs & Warnings

The largest ad programs are offering support to businesses impacted by COVID-19, e.g. Google provides $800+ million to support small businesses and crisis response to help small businesses manage through this period. Advertisers should pay close attention to the content of the creatives to avoid the spread of misinformation. Google, Reddit, Facebook, Microsoft, Twitter, and YouTube issue a joint statement on misinformation. Use cases for referencing to COVID-19 in ads that are posted by these platforms. Accurate ad content can prevent your ads from been removed or restricted from the feed.

Conclusion

The COVID-19 pandemic is a life-changing situation that also presents unique situation for advertisers. Facebook and Google have decreased the cost of advertising as they feel pressure from the pandemic. Carefully analyzing a myriad of factors – consumer behavior, industry, digital focus, ad KPIs – helps with the strategic decision of whether to increase, decrease, or even pause ad spending and how. If your company is fortunate enough to navigate these factors, it is a great opportunity to grow.